“We might be an old company but we are only looking forwards.” That very much sums up Adrian Bridge’s leadership style and ambitions for The Fladgate Partnership and the whole Port category and how it works with Mentzendorff in the UK.

Adrian Bridge is a business leader who relishes a challenge and as head of The Fladgate Partnership, that controls the interests of three of Port’s major brands, Taylor’s, Fonseca and Croft, he is used to dealing with a fair few of them. But even by the standards of the last 10 years – which has seen duty on a bottle of 20% abv Port increase by 90% since 2010 – having to endure a 44% duty hit in August was hard to take.

But talking to him last week he was very much in a “let’s get on with it” mode. Yes, he is angry, frustrated and disappointed that the government has chosen to hit fortified wine so badly in its big duty shake up that sets duty based on a drink’s alcoholic strength. But feeling sorry for yourself is not going to help you, your brands, or your customers make the most of what are still wonderfully crafted products that customers want to buy in their millions.

Although deeply frustrated by the big hikes in alcohol duty on fortified wine Adrian Bridge is still very much on the front foot and excited by his plans for the Fladgate Partnership and its core brands: Taylors, Croft and Fonseca.

Particularly at this time of the year. Which makes our conversation even more timely as Bridge, alongside Justin Liddle, the newly confirmed managing director of Mentzendorff, its UK importer in which it is also a major shareholder, looks to maximise every possible opportunity out of the vital festive and new year Port sales.

Bridge says the big duty increase in August has made it even more “difficult” to read the market and predict what might happen in the coming festive weeks. Particularly as so many of its major supermarket, retailer and on-trade customers shipped large volumes of Port in advance of the August duty increase in order to be able to make the most of this year’s Christmas trading.

“It has meant shelves have been full of Port earlier this year,” he says. So much so that many of its major customers have had to re-stock as customers have bought into the category earlier than usually do at this time of the year, he adds. “We are already seeing some big retailers re-ordering as they are getting stock pressures to get Port out to the shops. They have all built their displays a little earlier.”

Bridge says it won’t be until the first quarter of 2024 that the full impact of the August dutyincreases will be seen. One thing, though, he says, is sure “Port prices will change” and the whole category will move a couple of steps up the pricing ladder.

“It means Taylor’s LBV will be over £20 when not on promotion. There will have to be some re-adjustment.”

He also recognises that Port’s traditional core target audience of the professional middle class has been particularly squeezed by increased inflation and the knock-on effect on cost of living. But he remains bullish about what that means for potential festive Port sales.

“The evidence is people are not going to miss out on Christmas. They may not be going out as much, and drinking Port at the end of a meal, but historically, when that is the case, people drink more at home.”

Solid foundations

He adds: “Once we get past the the distorting noises of the duty increases then the overall Port business in the UK is still solid. The further up the premium scale you go, the less noticeable duty becomes anyway.”

He points to the great success it is enjoying with large format Tawny Ports – with great demand for its recently released five litre 50-year-old Taylor’s Golden Age Ole Tawny Port (see video above).

“It is working really well in the on-trade at that premium end. Restaurants are happy to invest in large format bottle as they are so visible on the floor and encourage others to order too.”

“It allows them to offer a much more value proposition,” he adds. “You are also guaranteed you are going to sell every glass as the Tawny is not going to go out of date. It also does not require a sommelier to handle it. A waiter can tell the story of a good 20-year-old Tawny.”

Taylor’s Golden Age 50 Year Old Tawny Port “is all about theatre,” says Mentzendorff’s Justin Liddle

“The large format Tawny is also all about the theatre,” says Justin Liddle. “When a sommelier comes to the table and pours it you have people all around the room looking at you. They will then buy as well. It feels deeply luxurious and adds to the overall experience of dining out.”

It is also, compared to a glass of malt whisky, incredibly good value for money and to have a 50 year old Tawny in your hand just feels a lot more special, he adds.

Bringing new products to the market like Taylor’s 50-year-old Golden Age Old Tawny Port is a great way to bring its stocks of port in its cellars to life, says Adrian Bridge

The key advantage for the Fladgate business is that it only needs to bottle to order and it is an innovative way to bring to life its ageing ports sitting in barrels in cellars in Porto. “It’s a great way for us to get bottles like this into the market.”

Liddle says it is great to see how well the large formats, and premium Port in general is dong in fine dining. “We are seeing really solid level of sales for Port through the on-trade.There are a number of factors influencing that. The five litre bottles have been fantastic in bringing incremental business for restaurants. Yes, people are going out less frequently, but they are looking for a real experience when they do.”

Bridge adds: “There are people with money who are looking for these sort of products and willing to spend money on them. That is the versatility of Port in that we can serve them something that is both aspirational, but also at a price they can afford.”

It’s why Mentzendorff is seeing such an interest in limited edition fine wines, says Liddle. “When people see an offer for something unique it really makes a difference.”

He adds: “The average spend on Champagne, for example, has stayed quite high across the premium on-trade. People are looking to make their evening a bit more special when they are offered a Port, or a Tawny or a Tawny Port with their pudding.”

He agrees with Bridge it is “extremely difficult to see a clear picture” for the Port market overall as the price point has clearly been affected by the duty rises.

Justin Liddle, managing director of Mentzendorff, says bringing unique products to the market like Taylor’s 50-year-old Golden Age Old Tawny Port is what its premium customers are crying out for

“But what we are seeing from our data over the last four weeks is that value is holding up. But there is quite a lot to unravel in those figures.”

It is noticeable, he adds, that some independent wine merchants are seeing Christmas orders coming through already, but that customers are “ordering quite conservatively”. “Their Christmas is a long way from starting.”

Liddle agrees and says whilst it is seeing “plenty of orders coming through” they are a “little smaller” that it is used to at this time of the year. “That said we had a good October which was on par with 2021.”

Which is why mid to end of November has been crucial for the Mentzendorff team to be out in the trade working with specialist merchants, putting on tastings and range reviews. “We have been involved in a myriad of tastings,” he says.

Christmas predictions

Port prices will be stronger this year with Taylor’s LBV retailing closer to the £12 and £12.50 mark, says Adrian Bridge

Bridge thinks the Port market will be a bit more bullish this year with less heavy discounting.

“We won’t be seeing Taylor’s LBV at £10 a bottle this year. It will be more like £12 to £12.50. Retailers are more likely to give promotions to their own loyalty customers through schemes like Nectar.”

He says Christmas is always a double edge sword for the big Port producers – particularly in retail. It’s still by far the most important trading weeks of the year, “and great we sell a lot of volume, but a lot of it is on promotion”.

The more profitable incremental trade is to be done in the on-trade, says Liddle, and it will be interesting to see how well premium and by the glass sales do this year. “They can be a real driver, like we have seen with the aged Tawny Ports.”

“Port in restaurants has always been that additional sale,” adds Bridge. “During the last recession we sold well in the on-trade. Particularly when there is less pressure to turn a table and you can encourage your customers to stay and relax. There is a lot of money to be had in the incremental sale.”

Travel opportunity

The demand and interest in limited edition drinks has encouraged Bridge, and the Fladgate Partnership, to explore the opportunities within travel retail for the first time. It was a first time exhibitor at the all important Tax Free World Exhibition in Cannes at the end of September where it introduced a new brand, the Taylor’s Port City Edition (see video above). Bridge was pleased with the “great response” it received at the fair, including a signing a distribution deal with Condor Ferries.

“It is quite exciting to see the opportunities for growth in travel retail. Particularly for Port,” he adds.

It’s why Fladgate has just taken on a new dedicated member of the team to focus on building its presence in travel retail.

“There are a lot of spirits in travel retail, but not a lot of wines, and Port certainly has a role to sit between those. We have been very pleased with it so far.”

Premiumising Port

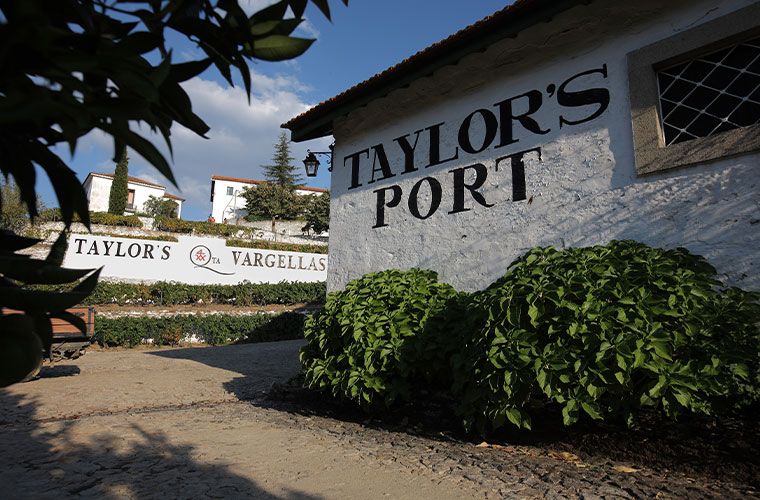

He adds: “Port has an impressive story to tell – at scale. We have to re-emphasise the artisan nature of what we do. So much of what we consume comes from a factory and is mass produced. Here you can come to Porto and see how Port is authentically made and just the way that people imagine.”

Which is why it is essential all is being done across the region to premiumise what it does, he stresses.

It is also time, he admits, for Port’s two power houses – The Fladgate Partnership and the Symington Group – to re-assess their roles and to ensure their head-to-head competition is not allowing the market, and the major retailers, in particular, to trade one off from the other in order to keep prices down.

The internal pressures in the Douro with rising dry good and labour costs, in particular, means producers need to be looking at how they can drive more value into their own market.

“Things have to change and the increase in duty does give us that moment to re-position the market and we must take it. 2024 will be a year of adjustments and the chance to premiumise.”

Innovating and adapting

Which has also opened up new innovation opportunities for Port, particularly around new formats like the success Fladgate has had with cans.

Bridge admits it has been a big learning curve for the business working with cans and quickly realised it is vital to have good on the ground distribution if you are going to be in the right channels and retailers to sell cans. It has, for example, signed a deal to work with Heineken in Brazil as it has such an extensive distribution model selling its beers to 70,000 points of distribution across local stores, bars and regional operators.

Introducing new formats for Port, like the success Croft has had with its can range, is the way forward for the category, says Adrian Bridge

“It has been really interesting for us and highlighted the possibilities there are to reach verydifferent parts of the market and different drinking occasions too.”

He says it has also been good for what is after all a 332 year-old company to be still innovating and finding new ways to work with and sell Port.

“You have to look forward and see what opportunities are out there,” he says. “We might be an old company but we are only looking forwards.”

The canned Port are also helping to challenge people’s perceptions of it being a high in alcohol drink, as the canned only have an abv of 5%, similar to most mainstream beer brands. It’s why its advertising for its canned range is focused on YouTube and social media and all about lifestyle, sipping Port by the pool, out in the sunshine. It’s why its marketing teams have been busy at music and food festivals this summer sampling, selling and talking to potential new customers about the new canned Port drinks.

“When people get the chance to taste the drinks they love them. If we can get past the gatekeepers it is an easy step to stimulate purchase.”

An opportunity to get people talking about Port and not just as an after dinner drink.

The highly impressive World of Wine attraction at Taylor’s in Porto is helping to tell the story of Port, its history and traditions and introduce it to new generations of people

As Bridge says: “We will continue to innovate and look at new ways we can drive the Port business and seed potential future drinkers.”

Which is why it works with the Gérard Basset Foundation and Liquid Icons to run the annual Taylor’s Port Golden Vines Diversity Scholarships to give people from different backgrounds around the world to take part in the Masters of Wine and Master Sommelier education programmes.

“We are an old company that can also provide leadership,” he adds, pointing also to the extensive work it has done around promoting sustainability around the world through the Porto Protocol it helped set up. A body that now has members across five continents, 22 countries, all working together to share their best ideas and practices on how the wine industry as a whole can tackle climate change.

“Our future is not just about us, but what else we can do as a role model to help others around the world,” says Bridge.

- You can find out more about The Fladgate Partnership here.

- Mentzendorff is a partner supplier to The Buyer. You can find out more about Mentzendorff here.