Andrea Smalling (AS), chief marketing officer and head of ecommerce sales at WineDirect and Cathy Huyghe (CH), co-founder and chief executive at Enolytics crunch the numbers from their first Direct to Consumer Impact Report.

We have seen how much e-commerce has taken off during Covid-19 – but you have some figures to prove it. Can you tell us about your new Direct to Consumer Impact Report and what you were hoping to achieve with it?

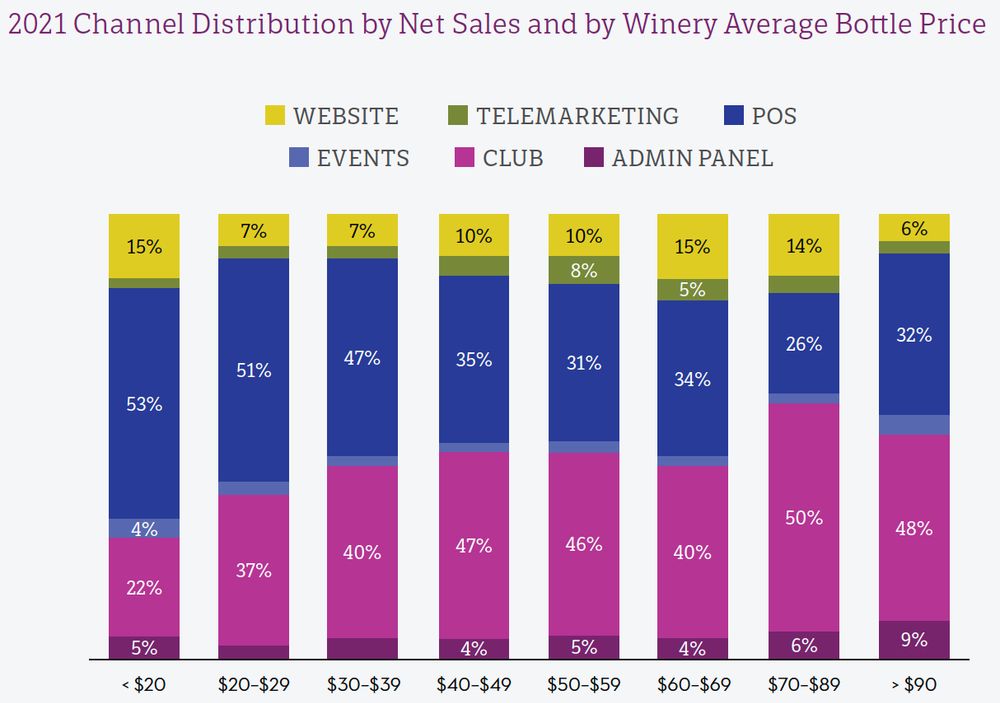

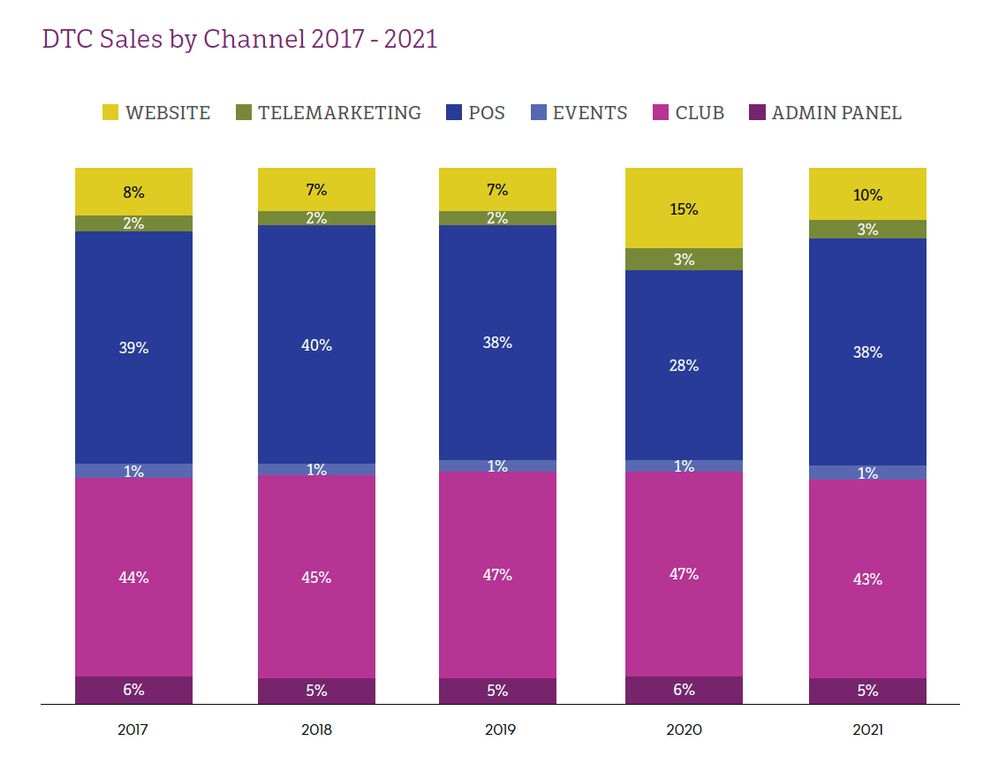

CH and AS: The figures in the report are rooted in WineDirect’s data, and they reflect each channel of the Direct-To-Consumer market including tasting room, cellar door, website, wine club, telemarketing and events. Enolytics’ contribution is the analysis, and setting up the data to be studied according to 20+ ‘measures’ and 20+ ‘dimensions’.

WineDirect and Enolytics have come together to produce a series of e-commerce impact reports

This report is the first of several that WineDirect and Enolytics will release together, because there is an incredible amount of valuable information to uncover from such a deep mine of data. With each report, we’re hoping to deliver meaningful insights that will benefit the industry as a whole, particularly as DTC continues to grow.

How did you go about putting it together?

CH and AS: It was an extraordinary amount of data, involving 162+ million orders and 25+ million consumers. Transferring that amount of anonymised data was a challenge, to be honest. The Enolytics’ DTC software is built natively to WineDirect, however, so the format of the data was already familiar. We structured it according to those 40 ‘measures’ and ‘dimensions’, and normalised the data according to those wineries who registered sales in their wine club, tasting room and website during the last five years.

Why have you decided to work together on this project?

CH and AS: WineDirect’s DTC data is the deepest in the industry and they have the biggest customer base, and Enolytics’ DTC software is built natively to WineDirect as a layer of analytics that sits on top of it.

Is it a case of matching the data and traffic figures from WineDirect with Enolytics’ ability to crunch the numbers?

CH and AS: That’s a great way to put it. WineDirect has the data, Enolytics has the technology. Together, our collective experience and knowledge of the industry helped us to create compelling visuals and a detailed textual supplement that we hope readers find very valuable and actionable.

Can you share some of the highlight figures from the report?

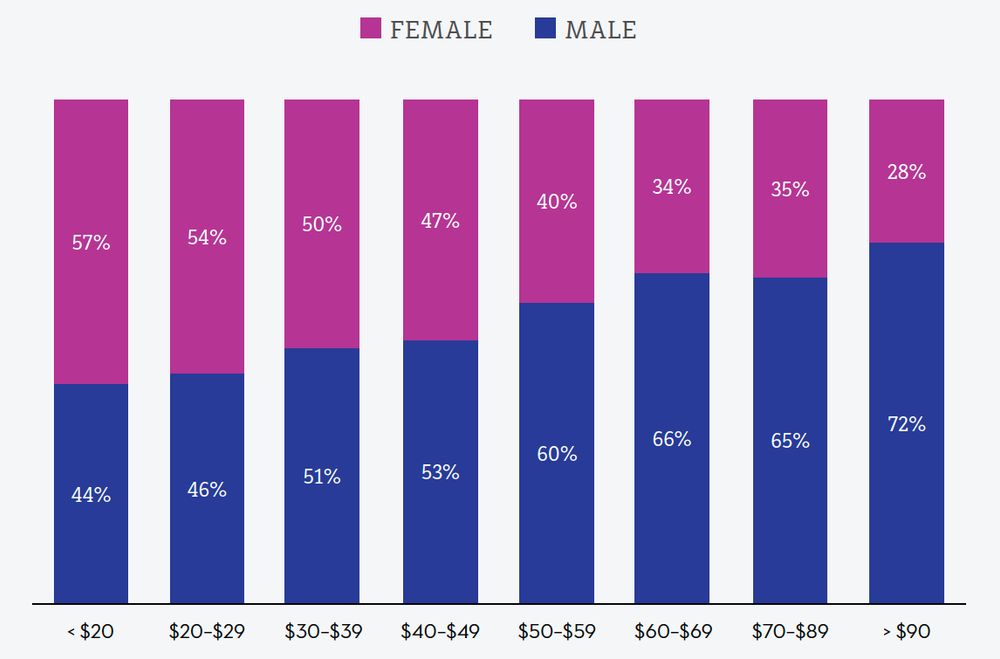

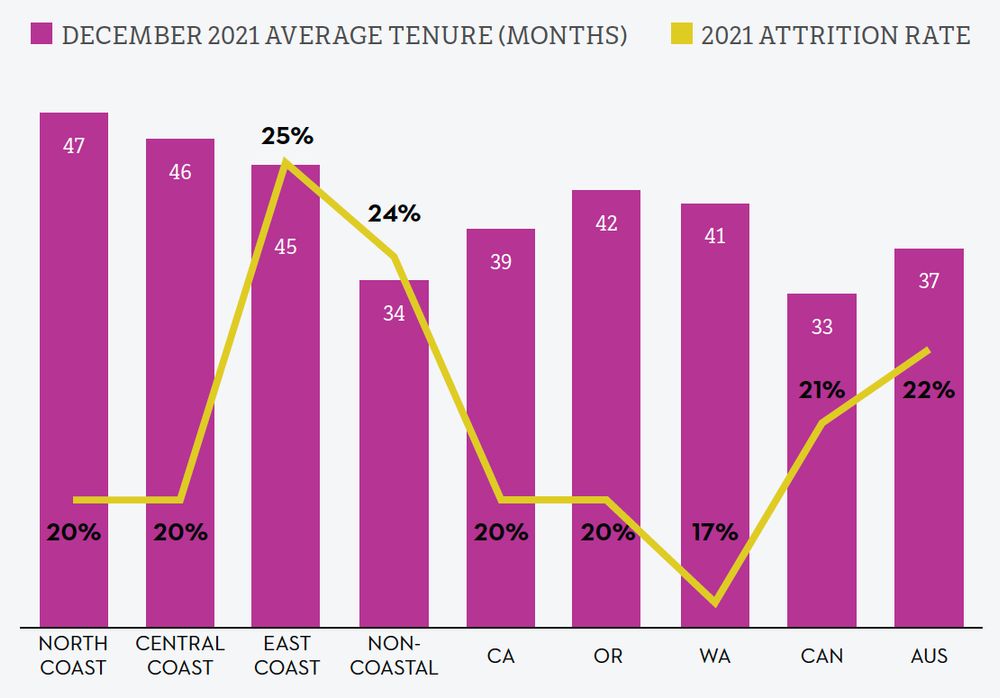

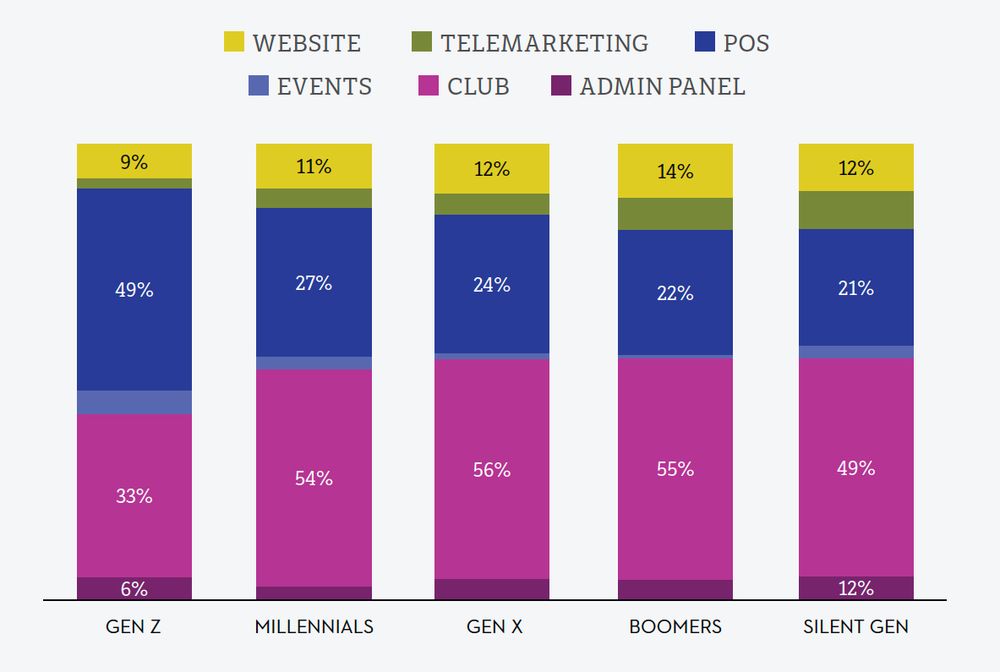

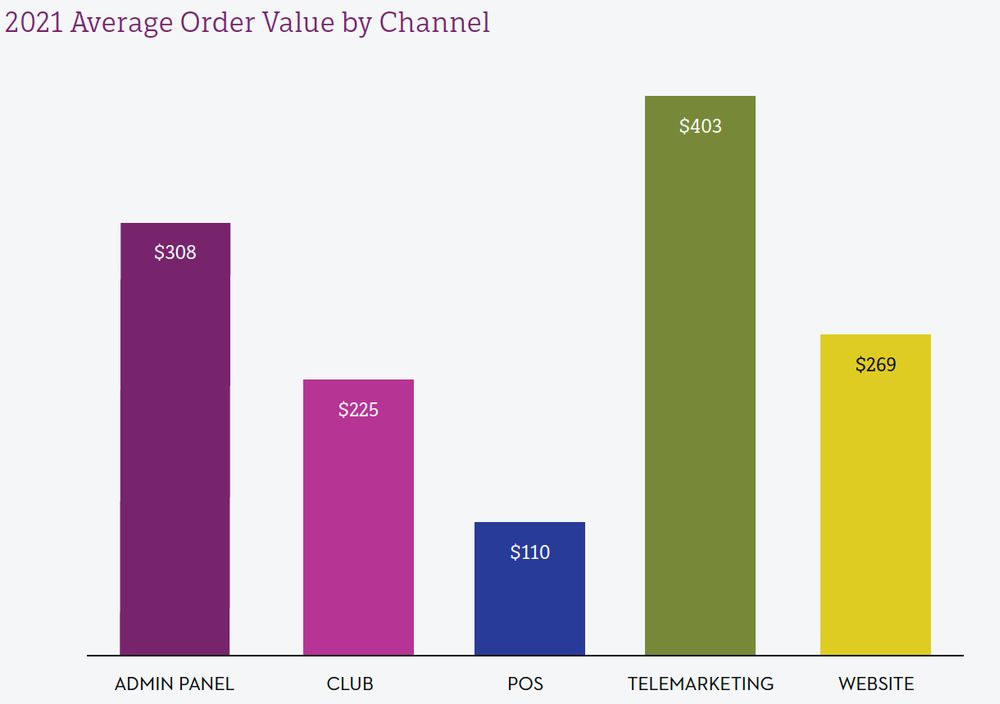

CH and AS: There were a lot, with so much more yet to discuss in upcoming reports. For this report, however, we were impressed to see the pace of website sales stay strong even once tasting rooms opened again post-Covid. We were also impressed to see that, after discounting wine sales during the pandemic, wineries have since clawed back the discounts and increased bottle prices again. The importance of repeat buyers (and gathering accurate data about them) was evident, and the purchasing trends of both women and younger consumers bode well for the DTC segment of wine’s future.

Is there anything you found out that really surprised you?

CH and AS: One of the advantages of all those ‘measures’ and ‘dimensions’ is the ability to “slice and dice” to really granular levels. Which means that generalised statements might be true at some 10,000 foot level, but not at the level that actually means something for an individual winery. Seeing the possibilities of that for the first time is, I think, surprising for readers. Take the example of “Women drink more white wine” as a blanket statement. At some broad level, yes, but it isn’t helpful when you consider the variables of women of all different ages plus the variables of all the different kinds of white wine plus the variables of production and price point. In those instances, which is the specific reality that individual wineries face every day, the blanket statement is only partially true. We can, and should, get far more granular and specific than that.

What are the big learnings you take from it?

CH: The biggest learning of all, for me, is that the data is there. Consumers are telling the wine world every moment of every day how they feel about wine and what they want. That’s data at a massive scale. It’s on us, as an industry, to make use of it, to follow the digital trail that consumers are leaving. We have the tools and the technology to do exactly that. It isn’t only possible but necessary for the future health of the industry.

What trends are likely to be here long term?

CH and AS: As Jim Agger from WineDirect said when he first spoke publicly about the report in January 2022, we no longer need to convince wineries of the importance of DTC. The shift to online wine buying has happened, and it’s here to stay. I also think that the growing importance of gender and generational trends is going to continue. The wine purchasing public looks very different now than it did five years ago, and smart businesses in the industry will understand what that means for them in the long term, and adjust accordingly.

Who is the report aimed at and you think will be most useful for people to read?

CH and AS: We envisioned our target audience for the report as an average winery in the US, Australia and Canada who have had wine club, tasting room and website sales for the past five years, dating back to 2017. We were very intentional, also, to include a section on “What To Do Today” that transforms key findings from the data into everyday applications for wineries of every size to put into practice.

Will you be looking to do future similar reports and use this as the starting point?

CH and AS: Absolutely. There is so much more to uncover. And the data is now set up for the slicing-and-dicing of upcoming reports. Our plans include additional reports according to varietal, channel, geography and demographics of consumers, pricing and seasonality.

For those that don’t know Enolytics how do you work?

CH: Enolytics has developed two Software as a Service (or SaaS) products, one for DTC and one for depletion (or sales) data, that are layers of analytics that sit on top of those two distinct data sets. Those are at the core of our business, and they make the data far more visible and usable for any wine or spirits business who already has DTC or depletion data.

The strengths of our team are solidly in technology development and content generation, so we’re also increasingly involved with projects where one of those two skills are needed. There is no shortage of data in the wine and spirits industry. We’re filling in the gaps of technology and content in order to make that data accessible and usable.

What sort of work have you been able to do during the pandemic?

CH: The pandemic impacted the industry’s DTC efforts tremendously. DTC teams really stepped up, whether or not their digital programs were fully fleshed out already. Our software facilitated those efforts, and it has been extraordinary to see people embrace it and go all in. There have been plenty of surprises of who comprises our user base – often not the people you’d expect – and their willingness to learn keeps inspiring us to do better and keep delivering the insights they need.

What do you see as the big opportunities still to be untapped in DTC?

AS: There is still a lot of opportunity to continue to build the entire DTC ecosystem. A lot of wineries seem to focus and allocate resources to one DTC channel at a time, when the huge wins will come from working them all together. Consumers journey through the channels according to things such as where they live, familiarity with your wines, time of year, even just what is going on in their lives at any given time. The key Is to capture their information so you can keep serving them relevant and engaging data wherever they are.

Is there a skills issue here as well and attracting the right skills to the sector?

AS: Wineries have learned a lot over the past two years, however, as an industry, wineries have generally been focused on producing the best wines, developing and executing the best hospitality programs along with more traditional marketing and PR. Using data to drive decision-making is relatively new for much of the industry, but it’s happening. With the production of this report, our goal was to spur further thinking and conversation as wineries lean further into this area.

What next for Enolytics and how do people get involved with working with you?

CH: It’s amazing to me how, in the years that Enolytics has been live, people throughout the industry look at our work and reply in entirely unexpected ways. It’s so exciting. Once they see what’s possible, it sparks a new idea or application that wasn’t there before. I love that, and it makes “what’s next” an adventure. In the meantime, we’ve got our core software products that we’re growing our user base around, and we’ve got other projects in the works where a business has data and needs technology and/or content.

- If you would like to find our more about the work that Enolytics does then contact Cathy Huyghe on cathy@enolytics.com or at Enolytics website here.

- You can find our more about WineDirect at its website here.

- You can download the full Direct to Consumer Impact Report here.